For travelers, who keep going on international trips more frequently, one of the relentless problems comes while changing the currency. As an Indian citizen, it leaves us with only a few options to deal with the currency exchange issue. Either we can carry cash that we exchange in the airport or any other preferred place. Or we can simply depend on the Forex cards provided by our banks.

However, in any of the above cases, the actual problem occurs during the exchange process. We have to decide in advance about how much amount we should exchange before actually moving to our trip. And such guesses always end up unsatisfyingly wrong. But now we have an easier and impressive option that will make our international trips much more fun.

This new product is called the NiYO Global Card. It is a next-generation card that helps in the seamless exchange of currency from anywhere in the world.

What is NiYO Global Card?

NiYO Global Card is the future of international currency exchange and transactions. It is an INR card that can be used globally for withdrawing money regardless of the currency. It is like a prepaid card where you can load money via NEFT, IMPS, or UPI. Later you can withdraw your amount from any bank ATM all over the world.

For instance, you load Rs. 1 Lakh to your NiYO card and withdraw it in Singapore Dollar currency. You can simply make your withdraw from any ATM in Singapore, and it will give you the exchanged amount for rupees. In this case, Rs. 1 Lakh would be somewhere around 1852 SGD.

Features of NiYO Global Card

NiYO became profoundly famous, especially for providing tons of options and generous all-time support. Besides, it comes loaded with a bundle of stunning features. Below we have mentioned some features that the NiYO card offers to its users:

Load Money

NiYO offers 3 different options for loading your amount via NEFT, IMPS, and UPI. Despite all these, the noticeable thing is, it doesn’t charge any additional amount on deposit.

International Withdrawals

The most highlighted part about this debit card is that it allows you to withdraw from any ATM all over the world. NiYO is available in over 150 countries. Hence, it lays the most straightforward path of making international withdrawals with no complications or paperwork.

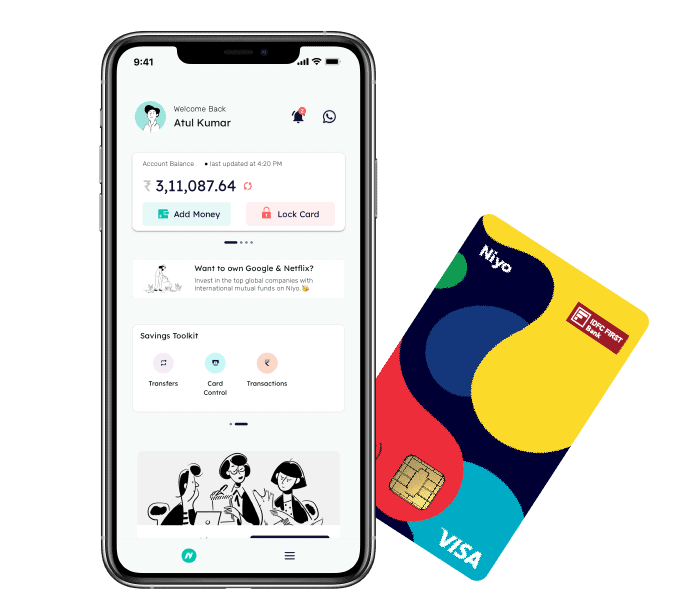

NiYO Global App

The NiYO debit card comes with its own companion. Using the global app, you can control your card and transactions. It allows you to track down your expenses, check real-time currency rates, lock/unlock your card, and more. You also get a built-in ATM locator that helps in finding the nearest ATM for instant withdrawals.

Reset PIN

The NiYO Global app even lets you change your PIN instantly. Initially, it comes with a pre-specified PIN, but you can manually generate any custom PIN later through the app.

Block Card

In case you lose your card throughout the journey, you can easily block your card using the NiYO Global app.

Seamless Transfer Back

You can effortlessly transfer back the unused amount to your bank account at any time.

The availability of NiYO is a huge number of countries that give us the option to load the amount in INR and spend it in any preferred currency. Moreover, with its dedicated app, you can track down your withdrawals and transactions. You can even increase or decrease the maximum limit of your card, preferably. These features give you the freedom to optimize and use your money anywhere and anytime.

Fee and Charges

Apart from its great features and the NiYO Global app, the most beneficial part appears in its additional charges.

- At present, NiYO has been issued entirely free of charge. There are no joining or renewal fees applied to date.

- No loading charges at all. Although the IMPS and NEFT charges might vary from bank-to-bank, there is no additional amount on using NiYO Global Card.

- 0% Forex markup charges. Generally, we are charged 3.5% as a markup charge, but with NiYO, everything is free.

- No additional charges on ATM withdrawals. However, a few amounts might be charged depending on which bank’s ATM you are using. (Private banks might usually have an associated amount on withdrawals.)

Support

Customer support plays a significant role in providing a satisfactory service to the users. Hence, NiYO support is available 24/7 anywhere, anytime via WhatsApp. You can put your query on their WhatsApp number, and they will come up with fast solutions to all your problems.

Now it seems like you know about all the basic features, benefits, and usage of the card. So, let me tell you that the NiYO card is partnered to three different banks DCB, IDFC First, and Yes bank. And each bank has its own particulars, statements, and charges. Here is what you need to know about each of them:

DCB NiYO Global Card

As per the schedule of fees and charges laid by the DCB Bank, you will be charged INR 200 as a joining and annual fee that you need to pay at the time of insurance. Plus, in case of reissue for a lost, stolen, or damaged card, you have to pay Rs—200 per instance.

Other than this, it doesn’t ask an amount for loading, domestic withdrawals, or domestic balance inquiry at DCB Bank ATM. However, for non-DCB ATM, it might charge around Rs. 20 per cash withdrawal and Rs.10 per balance inquiry.

On the other hand, for international cash withdrawals, you won’t be charged any amount for the first transaction every month. From the 2nd transaction, it would charge you INR 100 + applicable taxes and charges at actual as imposed by the gaining bank.

For international balance inquiry, the charges are again the same. Except for Rs. 100, it will cost you Rs. 50 per inquiry.

Features of DCB NiYO Global Card

- Enjoy Zero markup card as you only have to pay real-time exchange rates.

- Ability to load INR and pay in any currency all over the world. Visa exchange rates may apply.

- Supports instant transfer through NEFT/UPI/IMPS into the account linked with Niyo DCB Global Card.

- No commission on mutual funds investments.

- No commission on international investment markets.

- Ability to withdraw money, make POS, and online purchases in international markets.

- The card linked with the Niyo app, so customers can check real-time currency conversion rates, check account status, transfer funds, and change the ATM pin.

- Easy card blocking though Niyo app for both Android and iOS users.

- Submit bills though Niyo digital app, no need to keep paper bills!

- No minimum balance required.

IDFC First NiYO Global Card

IDFC offers a bunch of additional features to the customers. However, they might charge a considerable amount for the usage and maintenance of the account. And users have to agree to all the terms and agreements and even allow the bank to debit the chargeable amounts directly from their account.

Apart from that, IDFC First lays a huge list of terms & conditions along with some fantastic features as well.

Features of IDFC First NiYO Global Card

- Earn interest rates up to 7% per annum.

- Get a free international platinum debit card.

- Daily ATM withdrawal limit up to 100000.00/- INR.

- No commission on mutual funds investments.

- No commission on international investment markets.

- Zero markup charges while paying internationally, however Visa exchange rate may apply.

- Full digital KYC at the comfort of your home or office.

- Easy card blocking though Niyo app for both Android and iOS users.

Yes Bank NiYO Global Card

Just like IDFC, Yes Bank also comes with a few terms and conditions which consumers are supposed to follow under any circumstance. Speaking of the charges, Yes Bank might ask for an amount in case of renewal, replacement, or handling charges. On top of that, there might be different charges on specific transactions. Yes Bank will inform those from time to time.

You can either follow www.yesbank.in or www.goNiyo.com in order to keep yourself up to date.

Features of Yes Bank NiYO Global Card

- No minimum balance required.

- Easy card blocking though Niyo app for both Android and iOS users.

- Zero markup charges while paying internationally, however Visa exchange rate may apply.

- No commission on mutual funds investments.

- No commission on international investment markets.

- Zero markup charges while paying internationally, however Visa exchange rate may apply.

- No ATM withdrawal charges.

- The card linked with the Niyo app, so customers can check real-time currency conversion rates, check account status, transfer funds, and change the ATM pin.

- Easy card blocking though Niyo app for both Android and iOS users.

DCB NiYO Global Card Vs IDFC First NiYO Global Card Vs Yes Bank NiYO Global Card

All of these cards are Niyo Global cards however they are offered by different banks and is subject to their own set of rules and conditions.

| Features | DCB NiYO Global Card | IDFC First NiYO Global Card | Yes Bank NiYO Global Card |

|---|---|---|---|

| Account Type | Current | Savings @ 7% per annum | Prepaid Account |

| Load Currency | Load in INR | Load in INR | Load in INR |

| Markup charges | 0 markup | 0 markeup with 0 Comission in MF | 0 markeup with 0 Comission in MF |

| Minimum Balance | No minimum Balance | 10000 Minimum balance | No minimum balance |

| ATM Widrawls | Yes | Yes | Yes |

| POS transactions | Yes | Yes | Yes |

| Online Merchant Transactions | Yes | Yes | Yes |

| ATM charges | No | No | No |

Conclusion

After looking at all the Forex cards, we can say that NiYO offers the best features and services to date. It helps in simplifying the Forex transactions up to a great level. On top of that, it comes completely free of charge, which makes it a more affordable and attractive one. In a nutshell, NiYO Global Card is the best forex option for those who often travel out of the country.

However, we don’t recommend this for domestic purposes, as it significantly maximizes your benefits on international transactions. Hence, let us know which forex card do you use? And how would you rate NiYO compared to any other option?

I was аble to find good information from your blog

articles.

Thanks for the good article, I hope you continue to work as well.

I am delighted to discover this website. Thank you for your time just for this wonderful read! The information on your site is definitely helpful and I have you saved to my fav to see new updates.

Next time I read a blog, Hopefully it wont fail me as much as this particular one. I mean, Yes, it was my choice to read, however I really believed you would have something helpful to talk about. All I hear is a bunch of whining about something you could fix if you werent too busy searching for attention.